Mulligan Funding Privacy Notice

Revised 4/10/2025

Mulligan Funding, LLC (“Mulligan”), and for the benefit of FinWise Bank, a Utah State-Chartered Bank, Member FDIC, respects and protects all Mulligan Funding customers’ privacy rights and is committed to protecting your nonpublic personal information under the terms of this Privacy Notice. While you can use many features of our website without being required to provide personally identifiable information, you may be requested to provide your nonpublic personal information to gain access to some of our content or services, to contact us, or to receive additional information from us. By visiting www.MulliganFunding.com, you accept and agree to the practices described in this Privacy Notice.

For California residents, Mulligan’s California Supplement provides the PRIVACY NOTICE FOR CALIFORNIA RESIDENTS (“CA Privacy Notice”). The CA Privacy Notice grants various rights regarding the collection of personal information to consumers, including business owners and guarantors, who reside in California. Mulligan’s California Supplement is detailed below.

How We Collect and Use Nonpublic Personal Information

We collect basic data about our online visitors to better serve those who use our website, have an interest in our products, and make various requests. If you use our online application, that information is processed to help determine your funding eligibility. We do not share your data (your name, company name, US mail or email address, phone number, etc.) except as needed to process your request. By providing a phone number, you authorize Mulligan to contact you via phone calls and text messages. At any time, you may opt out of receiving communications from us by contacting us at support@mulliganfunding.com.

We may use Plaid Technologies, Inc. (“Plaid”) and only share your information with Plaid in accordance with this Privacy Notice. Information shared with Plaid is treated by Plaid in accordance with its Privacy Policy.

Automatic Information

We may also collect automatic information about your visit to our website, such as time of day, browser type and version, browser language, your operating system and platform, and the Internet Protocol (IP) address used to connect your computer to the Internet. This information is used for analytical purposes and to help us provide services to our clients. We may also use this information to administer and troubleshoot our website and servers.

Audio Information

All phone interactions with Mulligan Funding staff are recorded for monitoring and training purposes. Except where legally required, we do not share these recordings with third parties.

How We Protect Your Nonpublic Personal Information

We have taken precautions to protect your personal information under our control from misuse, loss, or alteration. Our security measures include industry-standard technology and equipment to help protect your data. Unfortunately, however, no system can ensure complete security, and you should take all necessary steps to protect your information and its transmission to us. Since the Internet is a public medium, we cannot guarantee the protection of your personal information.

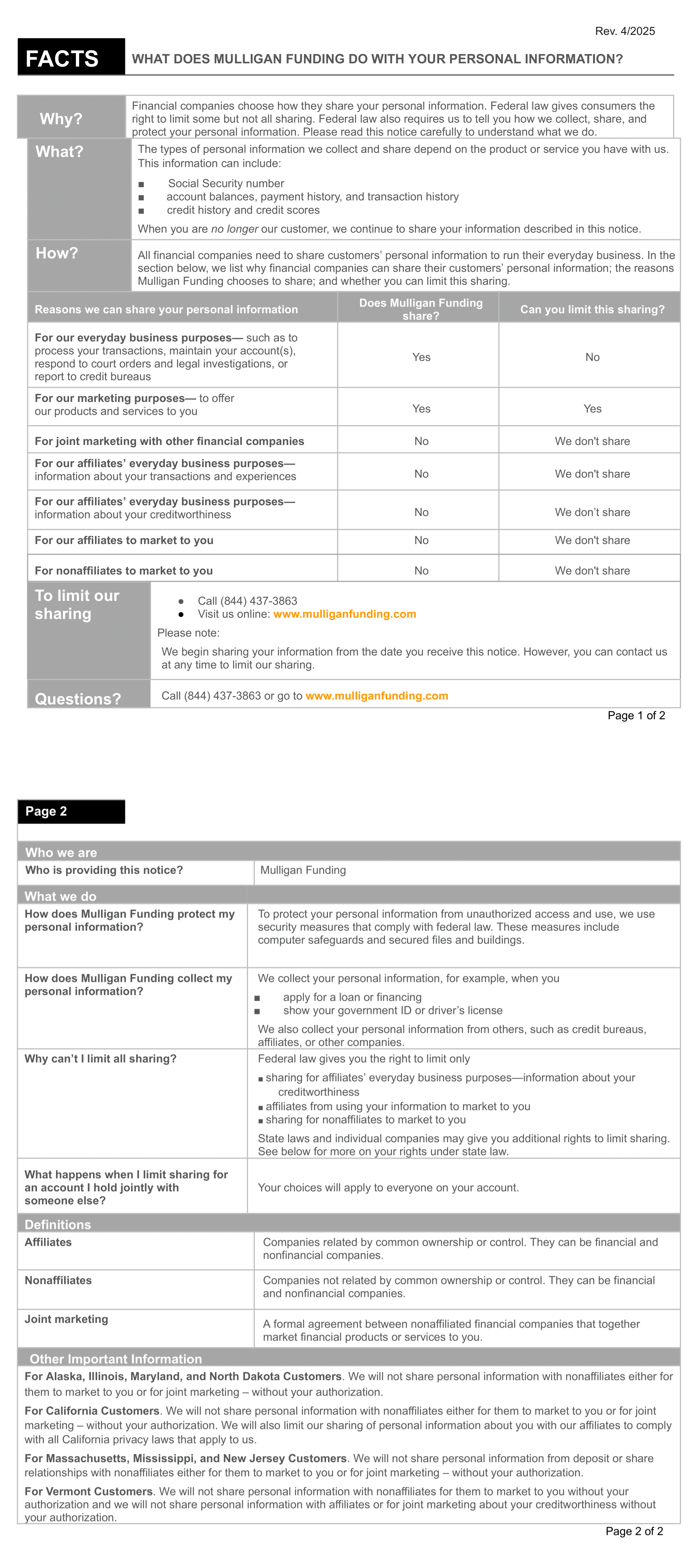

Facts – What Does Mulligan Funding do With Your Personal Information

How We Use “Cookies”

“Cookies” are small pieces of information that some websites store on your computer’s hard drive when you visit them. Like many other websites, we may use cookies to identify users and their preferences for our business purposes.

What We Provide to Third-Parties

Third-party agents may need access to some of your personal information. For example, we may need to share your name and address with credit reporting agencies, government regulators, or service providers. In such cases, we only provide third-party agents with the minimum amount of information needed to complete the requested service or transaction. We may also provide your information to our affiliated companies and successors. We reserve the right to provide third parties with aggregate statistics about our clients, traffic patterns, and related site information. This data reflects site usage patterns but does not contain personally identifiable information about any individual user.

Linked Websites

We may provide links to third-party sites. We encourage you to review the privacy policies posted on these third-party websites because we do not control these sites. We are not responsible for the privacy practices or content of such websites or the information collected on them.

Obtaining Your Consent

By using our website, you authorize us to collect information about the pages served to you as an anonymous user. This information will be used for the purpose of calculating aggregate site statistics.

Opt Out

We respect your privacy and ability to choose whether to share information with us and any third party. You may choose to opt out of sharing personal information in several ways. When choosing to use certain features or services on the website, you can choose whether to share optional personal information in connection with the feature or service. If you receive communication from us that you prefer not to receive, you may opt out of receiving them by specifically indicating this preference by emailing support@MulliganFunding.com. You may also opt out of providing personal information to us by not registering yourself as an authorized user of the website, thereby not providing personal information.

Children’s Privacy

We do not provide services to children. In accordance with the Children’s Online Privacy Protection Act, we do not knowingly request or solicit personally identifiable information from anyone under the age of 13. In the event that we receive actual knowledge that we have collected such personal information without the requisite and verifiable parental consent, we will delete that information from our database as quickly as is practical.

For more information about the Children’s Online Protection Act (COPPA), visit the FTC website at

www.ftc.gov.

California Privacy

This PRIVACY NOTICE FOR CALIFORNIA RESIDENTS (“CA Privacy Notice”) supplements Mulligan Funding Privacy Notice. Mulligan Funding has adopted this notice to comply with the California Consumer Privacy Act (“CCPA”) and other California privacy laws. It applies only to visitors, users, clients, and other persons if they are California consumers, as defined in the CCPA, and only to “personal information” that is subject to the CCPA (“Personal Information”). Any terms defined in the CCPA have the same meaning when used in this California Privacy Notice.

Personal Information We Collect and How We Use It

We may collect some or all of the following categories of Personal Information about California consumers:

Identifiers such as a name, alias, postal address, telephone or mobile phone number, unique personal identifier, online identifier, Internet Protocol address, email address, account name, Social Security number, driver’s license number, passport number, or other identifiers.

We use this information to identify you, process your application, and access your personal credit bureau report if you are a guarantor or business owner.

Personal Information (categories listed in the California Customer Records statute – CA Civil Code § 1798.80(e)) (“CCR Data”) such as your name, signature, Social Security number, address, telephone number, passport number, driver’s license number or government-issued identification number, employment history, bank account number or other financial information.

We use this information to identify you, process your application, and access our personal credit bureau report if you are a guarantor or business owner.

Protected Classification Characteristics under California or federal law such as age, citizenship, gender, marital status, physical illness, mental illness or disabilities, and veteran status.

We use this information to confirm your identity and that you are old enough to enter into a loan contract.

Commercial Information including records of personal property, products or services purchased, obtained, or considered, or other purchasing or consuming histories or tendencies.

We may consider this information when processing your application.

Internet or Other Electronic Network Activity Information (“Network Activity”) such as device ID, device ID type, website information, browsing history, search history, or information relating to consumer’s interaction with an internet website, application, or advertisement.

We use this information to analyze the use of our website and for fraud screening.

Geolocation data such as device location, IP location, or other information about a person’s physical location or movements.

We collect this information for fraud prevention purposes.

Audio, electronic, visual, or similar Information (“Sensory Data”) such as images, or recorded phone calls, audio, or video recordings.

We use this information for monitoring and training purposes with staff.

Professional or Employment-related Information such as current and past job history.

We may use this when underwriting our loans.

Inferences are drawn from any information categorized above to construct a profile about a consumer’s preferences, interests, characteristics, behavior, attitudes, intelligence, abilities, and aptitudes.

This information may be used for credit and fraud analysis and to target future marketing campaigns.

Personal Information does not include:

- Publicly available information from government records

- Deidentified or aggregated information

- Information excluded from the CCPA’s scope, such as:

- Health or medical information covered by the Health Insurance Portability and Accountability Act of 1996 (HIPAA).

- Personal information covered by certain privacy laws, such as the Fair Credit Reporting Act (FCRA), the Gramm-Leach-Bliley Act (GLBA), the California Financial Information Privacy Act (FIPA), and the Driver’s Privacy Protection Act of 1994.

We obtain the categories of personal information listed above from the following categories of sources:

- Directly from our applicants, clients, or their agents. For example, information provided as part of the loan application or related process.

- Indirectly from our clients or their agents. For example, through information we collect from our clients in the course of providing services to them.

- Directly and indirectly from activities on our website. For example, from submissions through Mulligan Funding’s website portal or website usage details collected automatically.

- From third parties that interact with us in connection with the services we perform. For example, referral partners and brokers provide us with loan applications or credit reporting agencies that provide us with information regarding a guarantor’s or business owner’s credit history.

Use of Information

We use the information we collect to:

- Compile, save, use and analyze your Personal Information in a personally identifiable form and as part of aggregate data.

- Operate, maintain, improve, and provide you with services.

- Conduct our business, including our lending partnerships, and refer your business to third-party small business lenders.

- Verify your identity and conduct appropriate due diligence.

- Review for potentially fraudulent activity.

- Process your loan application and determine whether or not your business qualifies for a product or service.

- Process transactions, including deducting automatic payments from your dedicated business bank account.

- Communicate with you by sending marketing communications, sending account update notifications, and responding to your business’s customer service requests.

- Conduct research and analyses to better understand our customers.

- Produce data analytics and reports containing deidentified summaries of Personal Information and other information that is not Personal Information, such as “General Information,” that we share with business partners. General Information may include Personal Information that has been aggregated and will not identify you.

Third Parties

We have disclosed and may disclose each category of Personal Information listed above to one or more third parties for business or commercial purposes. These purposes may include the following:

- Communicating with consumers

- Providing customer service and improving customer experience

- Marketing products and services offered by us or others

- Analytics, research, design, and development

- Counting ad impressions, assessing the quality of ad impressions, and auditing compliance

- Monitoring social media and other online references to us

- Preventing, detecting, and prosecuting malicious, deceptive, fraudulent, or illegal activity

- Maintaining or protecting our data and systems and ourselves

- Providing information to regulators, law enforcement, other governmental entities, and our attorneys, accountants, and auditors

- Making disclosures required by and otherwise complying with legal requirements or legal, regulatory, or other governmental investigations or process

- Any other purposes disclosed to or authorized, or approved by a consumer

- Sharing information with affiliated companies

Sale of Personal Information

We do not sell personal information.

Your Rights and Choices

The CCPA provides consumers, including California residents who are owners/guarantors of small businesses, with specific rights regarding their personal information. Mulligan Funding provides these rights to California residents who have provided their personal information as part of an application or loan. This section describes the CCPA rights and explains how to exercise those rights.

Access to Specific Information and Data Portability Rights

You have the right to request that we disclose certain information about our collection and use of your personal information over the past 12 months. Once we receive your request and verify your identity, we will disclose to you:

- The categories of information we collected from you.

- The categories of sources for the personal information we collected about you.

- Our business or commercial purpose for collecting that personal information.

- The categories of third parties with whom we share that personal information.

- The specific pieces of personal information we collected about you.

Deletion Request Rights

You have the right to request that we delete any of your Personal Information that we collected from you and retained, subject to certain exceptions. Once we receive your request and verify your identity, we will delete (and direct our service providers to delete) your personal information from records unless an exception applies.

Exceptions

We may deny your request to delete your Personal Information (and our service provider) if retaining your information is necessary to:

- Complete the transaction for which we collected the personal information, provide a good or service that you requested, take actions reasonably necessary within the context of our going business relationship with you, or otherwise perform our contract with you.

- Detect security incidents, protect against malicious, deceptive, fraudulent, or illegal activity, or prosecute those responsible for such activities.

- Debug to identify and repair errors that impair existing intended functionality.

- Exercise free speech, ensure the right of another consumer to exercise their free speech rights or exercise another right provided by law.

- Comply with the California Electronic Communications Privacy Act (CA Penal Code Section 1546 seq.).

- Engage in public or peer-reviewed scientific, historical, or statistical research in the public interest that adheres to other applicable ethics and privacy laws, when the deletion of the information may likely render impossible or seriously impair the research’s achievement if you previously provided informed consent.

- Enable solely internal uses that are reasonably aligned with expectations based on your relationship with us.

- Comply with legal obligations, such as retaining personal information collected to verify/identify under federal anti-money laundering laws.

- Make other internal and lawful uses of that information compatible with the context in which you provided it.

Exercising Access. Data Portability and Deletion Rights

To exercise the access, data portability, and deletion rights described above, please submit a request to us by:

Only you or a person registered with the California Secretary of State or other state agency you authorize to act on your behalf may request your personal information.

You may only request access or data portability twice within 12 months. The request must:

- Provide sufficient information that allows us to reasonably verify you are the person with whom we collected personal information or an authorized representative.

- Describe your request with sufficient detail that allows us to understand, evaluate and respond to it properly.

We cannot respond to your request or provide you with personal information if we cannot verify your identity or authority to make the request and confirm the personal information related to you. Therefore, we will only use personal information provided in a request to verify your identity or authority to make the request.

Response Timing and Format

We will respond to a request in writing within 45 days of receipt. If we require more time, we may extend our response up to 90 days from the date of receipt. We will inform you of the reason why we have extended our response time. If you have an account with us, we will deliver our written response to that account. If you do not have an account with us, we will deliver our written response by mail or electronically, at your option. Any disclosures we provide will cover the 12 months preceding the receipt of the request. The response we provide will also explain why we cannot comply with a request, if applicable.

We do not charge a fee to process or respond to your request. Therefore, unless your request is excessive, repetitive, or simply unfounded, we will not deny the request.

Non-Discrimination

We will not discriminate against you for exercising any of these rights. Unless permitted by the CCPA, we will not, because you have exercised rights under the CCPA:

- Deny you goods or services

- Charge you different prices for goods or services, including through granting discounts or other benefits or imposing penalties

- Provide you a different level or quality of goods or services

- Suggest that you may receive a different price or rate for goods or services or a different level or quality of goods or services

California Civil Code Section 1798.83 permits California residents to request certain information regarding disclosing personal information to third parties for their direct marketing purposes. To make such a request, please email support@mulliganfunding.com.

Compliance with Legal Process

Please be aware that we will release specific personal information about you if required to comply with any valid legal process such as a search warrant, subpoena, statute, or court order. We may also choose to establish or exercise our legal rights or defend against legal claims but are not under any obligation to do so.

Contact Us

Any questions or concerns regarding this Privacy Notice, please contact us at support@mulliganfunding.com or by snail mail to:

Mulligan Funding, LLC

4715 Viewridge Avenue

Suite 100

San Diego, CA 92123

855-326-3564

Notice Updates

We may change this privacy notice at any time at our sole discretion. Any updates to our privacy notice will be posted on this page so that you are always aware of what information we collect, how we use it, and under what circumstances we disclose it. If we update this notice, we will revise the “date of most recent update” posted at the top of this Notice. Continued use of the site following our posting of a change notice or updated privacy notice will constitute binding acceptance of those changes.